BRAZIL: Wind energy deals up 250% YTD

The volume of wind energy transactions has increased by 250% year-to-date in 2015 compared to the same period of 2014.

MEXICO: Real estate market buoyed by REIT deals

Mexico’s REITs have helped maintained buoyancy in real estate transactions in what has elapsed of 2015. Deal volume is up 13.33% compared to the same period in 2014 while combined deal value is up proportionally by 13.5%. Among the most notable transactions was Fibra Macquarie México’s acquisition of City Shops del Valle valued at USD 215m.

|

Rankings / League Tables

|

Latin America Ranking – 2015

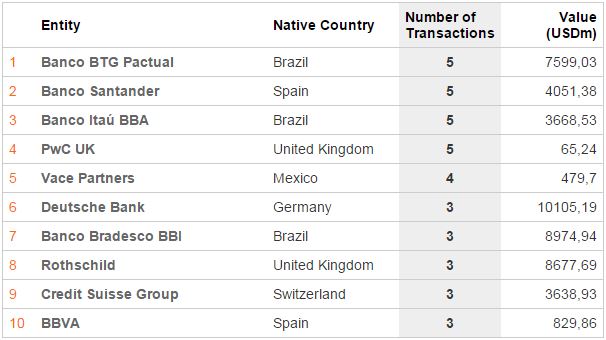

Financial Advisory – Year to Date (YTD)

Banco BTG Pactual maintains its leadership in Latin America’s financial advisory ranking YTD with five deals worth USD 7.5bn, up from its second-place ranking at the same time of year in 2014 when it had advised on 12 transactions whose combined value didn’t reach USD 2.5bn. Spain’s Banco Santander rose from eighth spot at the same time of year in 2014 to take the number two spot, while Brazil’s Itaú fell in the ranking from first in mid-April 2-14 to third at mid-April 2015.

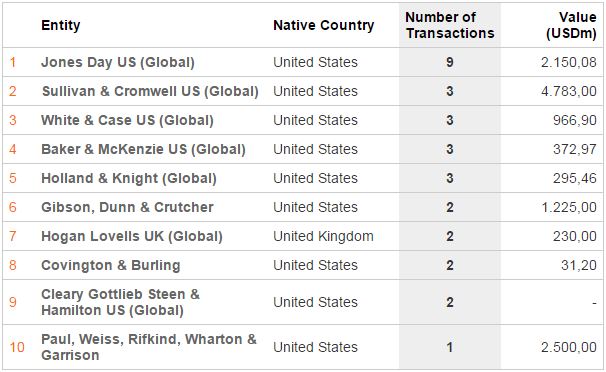

Legal Advisory – Year to Date (YTD)

Jones Day jumped from third position at mid-April, 2014 to lead the legal advisory rankings YTD in 2015 with nine transactions worth a combined USD 2.15bn compared to its seven deals at this time of year in 2014 worth USD 1.47bn. Sullivan & Cromwell, absent from the top-10 ranking at this time of year in 2014, takes the number two spot with three mega deals worth a combined USD 4.78bn. No stranger to high ranking, White & Case rose from ninth in mid-April, 2014 to take the number three spot with three transactions worth nearly USD 1bn.

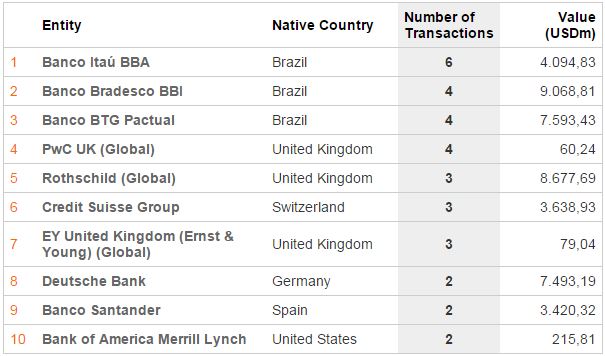

Brazil Ranking – 2015

Financial Advisory – Year to Date (YTD)

Banco Itau BBA and BTG Pactual have maintained their number one and number two rankings, respectively YTD in 2015 compared to the same period of 2014. PwC has made a rapid rise to number three spot by deal volume with four deals after making no appearance in the top-10 ranking at this stage of 2014. Its four deals pale in size to banks like Bradesco BBI and Rothschild which follow in the 2015 rankings at mid-April with USD 8.97bn and USD 8.68bn in combined deal value, respectively.

Legal Advisory – Year to Date (YTD)

Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga has had a great year, by any measure, leading the legal advisory ranking at mid-April with 12 deals valued at a combined USD 9.2bn. Brazil’s leading firm YTD rose from fourth at the same time of 2014. At the number two spot, Demarest Advogados rose from eighth at this time of year in 2014 when it had advised on seven deals worth USD 183m compared to its 12 deals worth a combined USD 1.4bn in mid-April, 2015. Souza, Cescon, Barrieu & Flesch has also accomplished a sharp rise in the ranking from seventh with seven deals to third with 11 worth a combined USD 3.8bn in 2015 YTD.

Mexico Ranking – 2015

Financial Advisory – Year to Date (YTD)

Vace Partners inched ahead of the pack by deal volume by mid-April, 2015 with two deals worth a combined USD 480m. While the advisory firm trails by deal value, it can boast its leadership after not appearing among the top 10 at this stage of 2014. Deutsche Bank appears at number two in Mexico’s financial advisory ranking YTD in 2015 with a single deal worth USD 2.6bn. It too was absent from the top 10 in 2014, and bumped Citigroup, also with one deal, to the number three spot from number two at this point in 2014. Moelis & Company shares the number three spot with Citi having advised on the same transaction in which Heineken sold its packaging unit, Empaque to Crown Holdings.

Legal Advisory – Year to Date (YTD)

Creel, García-Cuéllar, Aiza y Enríquez can pat itself on the back for maintaining its leadership in the January to mid-April period compared to the same period of 2014 by deal volume with nine transactions again in 2015 YTD. Galicia Abogados rose from fourth to second place in the YTD rankings comparing the same periods with thee deals worth a combined USD 5.2bn so far this year. Jones Day, also with three deals, ranks third weighted by combined deal value, after not appearing among the top-10 firms in mid-April, 2014. Nader Hayaux & Goebel has had an excellent year as well. Despite climbing only one spot in the YTD ranking to sixth, the combined value of Nader’s two transactions in Mexico is nearly 25x greater than its two deals at this time of year in 2014.