Corporate Partner and Head at

Pérez-Llorca New York office

TTR interviews Iván Delgado, from Pérez-Llorca New York. The partner compares last year’s M&A market in Latin America with 1st half of 2017.

(ENGLISH)

Mr. Delgado, we already had the pleasure of interviewing you last year. Compared with the M&A market in Latin America in 2016, how would you describe the progress of the market so far this year? Have you seen any significant changes in trends? If so, to what do you think it is due?

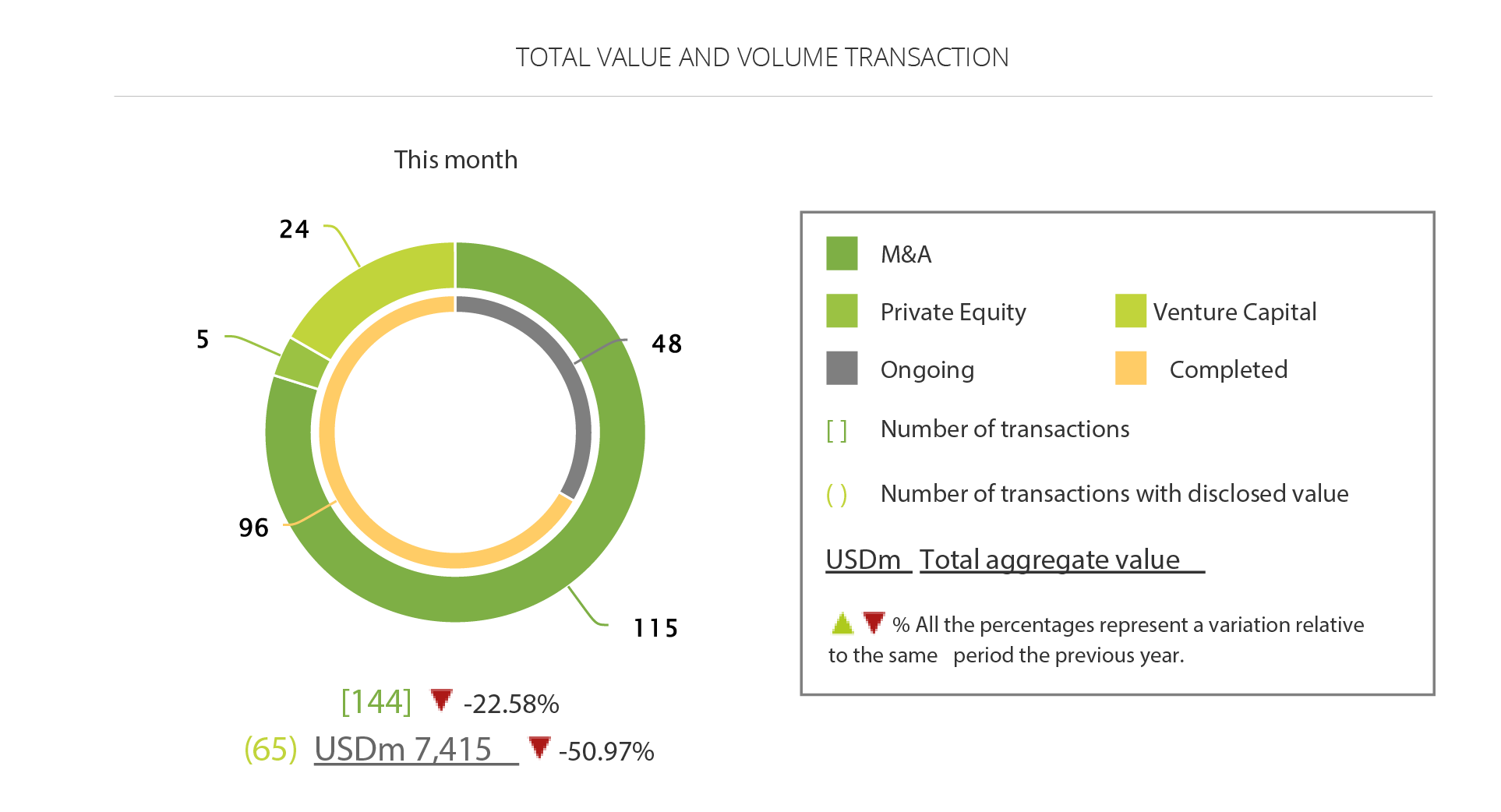

I would describe the progress as positive. In the second quarter of the year we have seen a slight increase in transactions compared to the same period of the previous year (493 vs. 509 transactions, respectively). While I believe that there has not been a significant change in this trend, there has however been an increase in the number of transactions that are closing, which could be interpreted as a sign of foreign investor confidence in Latin America, despite the political instability we have seen in recent years in certain countries in the region.

With regard to the private equity market, a segment in which you are an expert, according to TTR aggregate YTD data, investment by private equity firms in Latin America appears to have decreased in comparison with the previous year. However, in this last quarter, there have been more transactions occurring than during the same period in 2016. How would you take stock of private equity activity?

I think the trend in 2017 with respect to private equity is positive. While the first quarter, as shown in the statistics, had less activity than last year, it seems that the sector is finally back on track in terms of growth. Forecasts for the second half of the year are also positive.

With regard to private equity firms investing in Latin American companies, those which most stand out are firms whose headquarters are located in the United States, the United Kingdom and Canada. As head of Pérez-Llorca’s New York office, what qualities or characteristics of Latin American companies do you believe attract the interest of foreign investors?

In Pérez-Llorca’s experience, when investing in Latin American companies, private equity firms mainly value: (I) the company’s good reputation in the field of corruption and prevention of money laundering; (ii) the consolidated position of the company in the local or regional market; and (iii) the desire for international growth with a view to expanding and integrating into other markets.

With regard to the activity of venture capital firms in LatAm, a growing trend has been identified over the course of 2017. Do you think that there is a greater interest on the part of investors in newly incorporated companies and in the entrepreneurial world, in line with global trends?

Yes. In recent years we have seen how interest in newly created companies has grown exponentially worldwide. Latin America is no exception and although it has not been at the same pace as other markets such as the European or American markets, venture capital fund investment has grown considerably in the region.

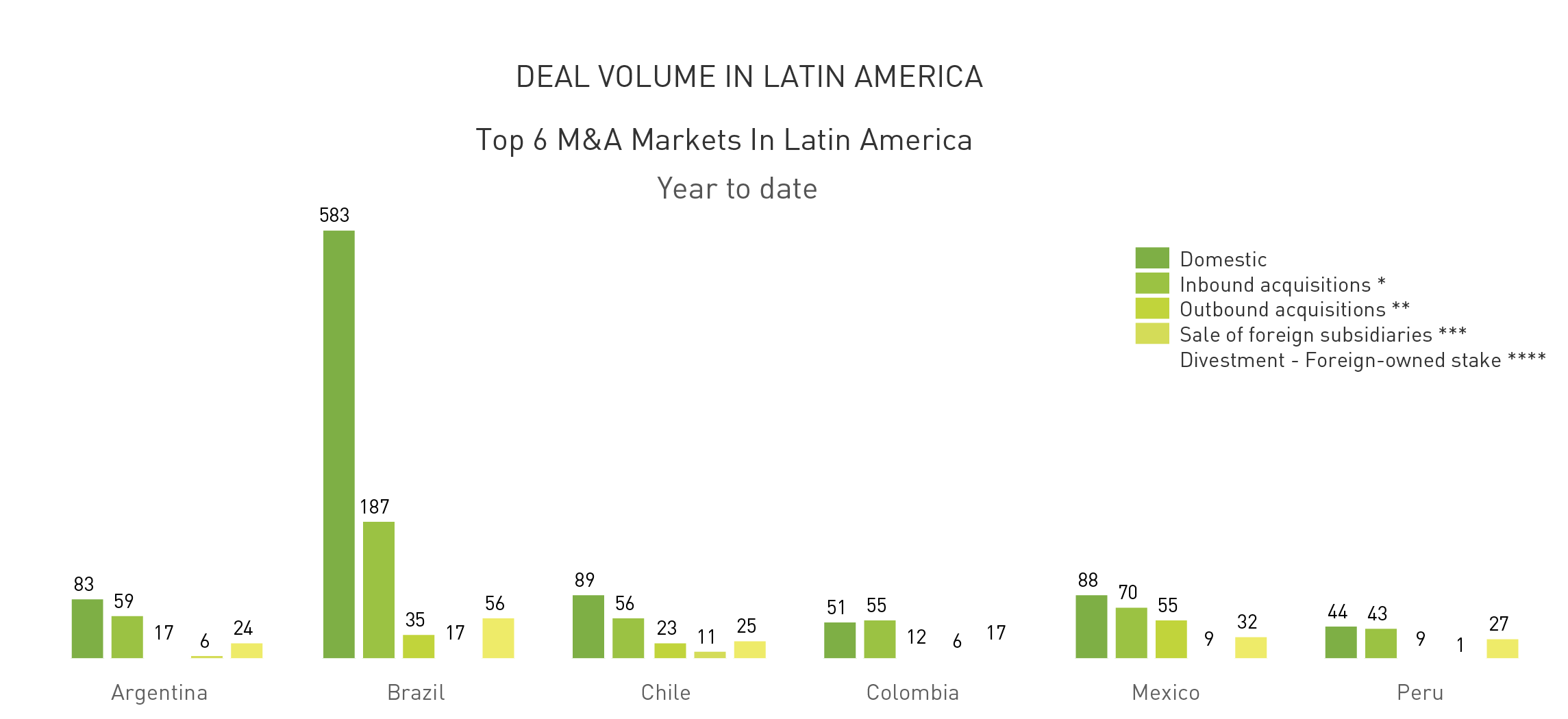

Generally speaking, so far this year, we have seen a modest upward trend in activity in the M&A market in Latin America, from country to country. What does the future hold for the end of the financial year? In your opinion, which Latin American countries do you consider are showing a greater potential for growth in investments?

The forecast for the second half of the year is positive. We hope that the number of transactions continues to increase. In my opinion, the Latin American countries with the greatest potential for growth in the short term are: Peru, Argentina and Chile, as shown in recent years (mainly in M&A, private equity and venture capital transactions, without forgetting the large markets of Mexico and Brazil.

(ESPAÑOL)

Sr. Delgado, ya tuvimos el placer de entrevistarlo el año pasado, en comparación con el escenario de M&A en Latinoamérica en 2016, ¿cómo describiría la marcha del mercado en lo que llevamos de año? ¿Se ha podido apreciar algún cambio de tendencia significativa según su opinión? De ser así, ¿a qué cree que es debido?

Positiva. En el segundo trimestre del año hemos visto un ligero aumento de las operaciones respecto al mismo período del año pasado (493 vs. 509 transacciones, respectivamente). Si bien creo que no ha habido un cambio significativo en la tendencia, sí podría destacarse el incremento de las operaciones cerradas, lo que puede interpretarse como una muestra de confianza del inversor extranjero en Latinoamérica, a pesar de la inestabilidad política en determinados países de la región que hemos visto en los últimos años.

En cuanto al mercado de private equity, segmento en el que usted es especialista, según lo registrado en TTR, de manera agregada YTD se ha observado que en Latinoamérica han disminuido las inversiones de firmas de capital riesgo en comparación con el año anterior. Sin embargo, en este último trimestre sí que se han superado las operaciones ocurridas durante ese mismo periodo en 2016. ¿Qué balance haría de la actividad private equity?

Creo que la tendencia en 2017 respecto a private equity es positiva, y YTD el balance también. Si bien el primer trimestre, tal y como reflejan las estadísticas, la actividad fue menor que la del año pasado, parece que finalmente el sector ha retomado la senda del crecimiento. Las previsiones para el segundo semestre son igualmente positivas.

En cuanto a las firmas de private equity inversoras en empresas latinoamericanas, destacan aquellas cuya sede se encuentra en Estados Unidos, Reino Unido y Canadá. Como responsable de la oficina de Pérez-Llorca en Nueva York ¿Qué cualidades o características de las sociedades latinas cree que despiertan el interés de los inversores extranjeros?

En la experiencia de Pérez-Llorca, a la hora de invertir en empresas latinoamericanas las firmas de private equity valoran principalmente: (i) la buena reputación de la compañía en materia de corrupción y prevención de blanqueo de capitales; (ii) la posición consolidada de la compañía en el mercado local o regional; y (iii) la vocación por la proyección y crecimiento internacional de cara a una futura expansión e integración en otros mercados.

Respecto a la actividad de las firmas de venture capital en LatAm, se ha observado una tendencia creciente a lo largo de 2017, ¿cree que existe un mayor interés por parte de inversores en las sociedades de nueva creación y en el universo emprendedor, siguiendo la tendencia global?

Sí. En los últimos años hemos visto como el interés por las sociedades de nueva creación ha crecido de manera exponencial a nivel global. Latinoamérica no ha sido la excepción y, si bien no al mismo ritmo que otros mercados como el europeo o el estadounidense, ha experimentado también un crecimiento considerable la inversión de fondos de venture capital.

En general en lo que llevamos de año, de un modo más o menos modesto según el país, se han reflejado unos datos positivos que manifiestan un incremento de la actividad en el mercado de M&A latinoamericano, ¿qué futuro próximo augura para el cierre del ejercicio? Según su criterio ¿cuál o cuáles son los países latinos que considera están mostrando un mayor potencial de crecimiento en inversiones?

La previsión para el segundo semestre del año es positiva, esperamos que el número de operaciones siga aumentando. En mi opinión, los países de Latinoamérica con mayor potencial de crecimiento a corto plazo son: Perú, Argentina y Chile, tal y como vienen demostrando en los últimos años (principalmente en operaciones de M&A, private equity y venture capital), sin olvidar de los grandes mercados que siempre han sido y son Méjico y Brasil.