- Deal volume in LATAM increased 3% in 2Q17 over 2Q16

- Aggregate deal value is up 86%

- Deal of the Month: Grupo México Transporte acquires Florida East Coast Railway for USD 2bn

TTR Insight

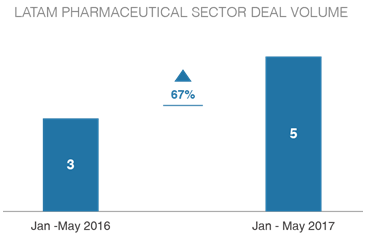

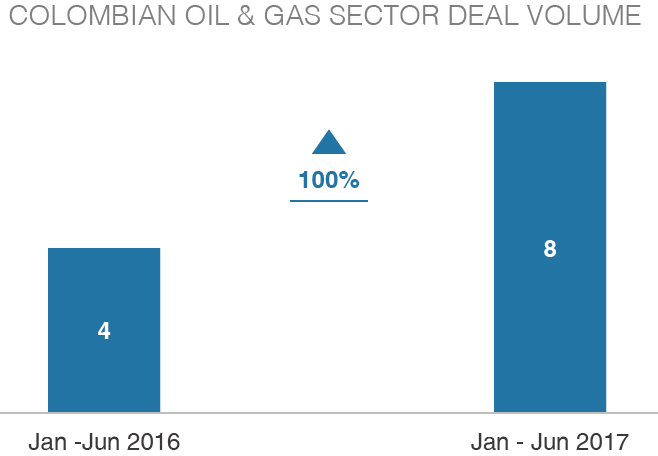

Deal volume in Colombia’s Oil &Gas sector increased 100% in 1H17 over the same six-month period in 2016, according to Transactional Track Record data. There were eight announced and closed transactions in the sector in the first six months of 2017 compared to four in 1H16.

Deal volume regionwide rose 3% in 1Q17 over 1Q16, with 509 announced and closed transactions in Latin America to the close of June. M&A activity is up 5% YTD, meanwhile, with 1,026 announced and closed deals in the region in 1H17.

Aggregate transaction value increased by 86% in 2Q17 over 2Q16 to USD 33bn regionwide, taking into account 218 deals of disclosed consideration. YTD, aggregate deal value is up 85% to USD 73.4bn, including 417 announced and closed transactions of disclosed consideration regionally in 1H17.

Top Six M&A Markets in LATAM

Brazil led deal flow regionally with 512 transactions together worth USD 44.5bn in 1H17, up 8% by volume and 220% by aggregate value compared to 1H16. There were 209 announced and closed deals of disclosed consideration in Brazil to the close of June contributing to 1H17 aggregate value.

Mexico follows with 148 deals worth a combined USD 10.7bn, up 1% by volume, down 13% by aggregate value, taking into account 57 deals of disclosed consideration, relative to the same half-year period in 2016.

Chile ranks third regionally with 120 deals together worth USD 5.1bn to the close of 1H17, up 13% by volume and down 49% by aggregate value over the first six months of 2016, taking into account 54 transactions of disclosed consideration.

Argentina continues to garner growing deal flow, with 117 announced and closed deals in 1H17 worth a combined USD 3.6bn, up 13% by volume and 3% by aggregate value, considering 41 transactions for which a consideration was disclosed.

Colombia registered 78 deals in 1H17, the same volume as in 1H16, while aggregate value grew 155% to USD 13.1bn, taking into account 30 transactions of disclosed consideration.

Peru rounds out the top six M&A markets in the region, notwithstanding a sizeable dip in both transaction volume and aggregate deal value. Transaction volume fell 27% to 58 deals while aggregate deal value declined 26% to USD 1.7bn, taking into account 32 transactions of disclosed consideration.

Cross-Border Deals

LATAM firms made 15 extra regional cross-border acquisitions in 2Q17, eight with targets based in North America, four in the EU, one in Asia and one in Australia. EU-based buyers led inbound acquisitions in Latin America in 2Q17, with 67 deals originating from the old world, US and Canada following with 59 transactions. Asian buyers led 19 transactions in Latin America, Australian firms seven and a sole Africa-based acquirer invested in the region.

Deal of the Quarter

TTR selected Grupo México Transporte’s USD 2bn acquisition of Florida East Coast Railway from Fortress Investment Group (NYSE:FIG) as Deal of the Quarter in LATAM. The buyer was advised by Galicia Abogados, Dechert and BBVA Bancomer, while the target was advised by Cravath, Swaine & Moore, Sidley Austin, Barclays Bank and Morgan Stanley.

Interview with Posadas, Posadas & Vecino

Tomás Gurméndez, partner at Posadas, Posadas & Vecino, discusses the M&A market in Uruguay and across Latin America

Tomás Gurméndez, partner at Posadas, Posadas & Vecino, discusses the M&A market in Uruguay and across Latin America

(Interview in English and Spanish)

TTR in the Press

BN AMERICAS – “Regional M&A activity shows heavy surge in valuation in H1”

AMÉRICA ECONOMÍA – “Fusiones y adquisiciones de América Latina aumentan 86,38% en el 2Q17”

EL FINANCIERO – “Las mexicanas duplican el valor de compras en EU”