TTR Deal Tracker

www.TTRecord.com

LATIN AMERICA

BRAZIL: Private equity transactions on the rise

Private equity deals have increased unabated YTD in Brazil with an 18.64% jump in deal volume between January and mid-September, 2015, compared to the same period in 2014, according to TTR data (www.TTRecord.com). The total number of deals in which private equity funds deployed capital in Brazil grew from 51 to 56, while the number of exits increased from eight to 14.

COLOMBIA: Retail and distribution take increasing share of total deal volume

Deal volume in Colombia’s retail and distribution sector has grown 100% YTD in 2015 while the aggregate value of deals in the space is up 1,780% compared to the same period in 2014, according to TTR data (www.TTRecord.com). A total of 10 transactions in the space in the first nine-and-a-half months of 2015 are worth USD 1.92bn combined. Among the most noteworthy of these is the USD 1.86bn acquisition of a stake in France-based Ségisor by Colombia’s largest retailer, Almacenes Éxito.

|

Rankings / League Tables

|

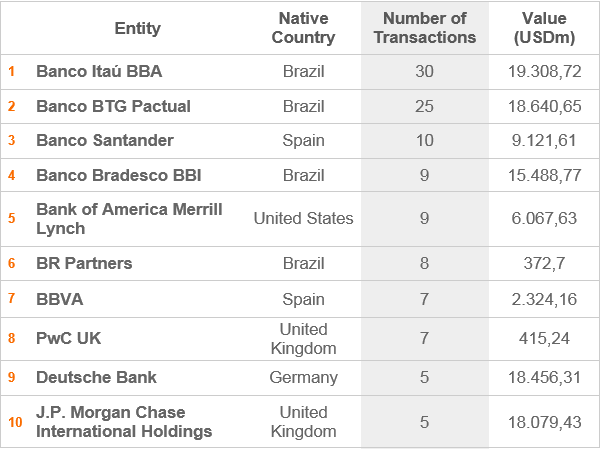

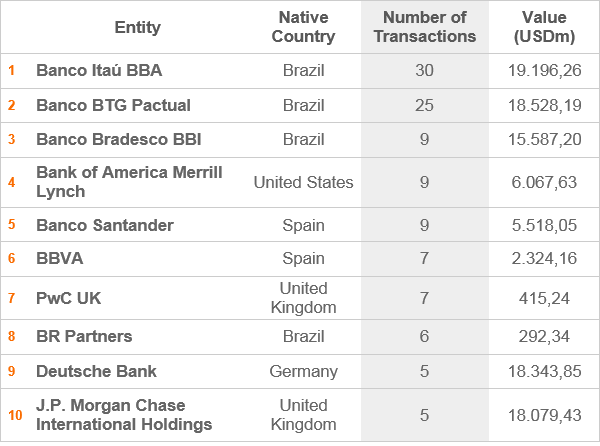

Latin America Ranking – 2015

Financial Advisory – Year to Date (YTD)

Banco Itaú BBA continues to lead TTR’s Latin America financial advisory ranking at mid-September with 30 transactions under its belt YTD worth a combined USD 19.3bn. Deal volume is down 40% for the region’s top bank compared to its 50 deals for the same period in 2014, but aggregate value is up 128% compared to its USD 8.5bn in combined deals a year ago, when it also led the chart. Following in second, as it did a year ago, Banco BTG Pactual has advised on 25 transactions YTD, worth a combined USD 18.6bn, compared to 30 a year ago, together worth USD 11.2bn. Banco Santander, which has advised on 10 deals together worth USD 9.1bn YTD, is up two places to take third in the chart relative to this time last year when it’d advised on 12 deals worth USD 3bn. Banco Bradesco BBI holds the same fourth-place position it held in mid-September, 2014, with nine deals worth USD 15.5bn combined. A year ago it had advised on 12 deals worth USD 5.1bn. BAML, which has swapped ranking with Santander in the past 12 months, now holds fifth with nine deals together worth USD 6bn, down from 12 a year ago worth USD 10bn. BR Partners takes sixth, followed by BBVA in seventh and PwC in eighth. All three were absent from the regional top 10 in mid-September, 2014. Deutsche Bank holds to the ninth-place ranking it held a year ago, with five deals worth USD 18.5bn, compared to eight worth USD 10.8bn then. JPMorgan is in tenth, also with five deals, worth a competitive USD 18bn, putting it in fourth by aggregate value behind Deutsche, BTG Pactual and Itaú BBA.

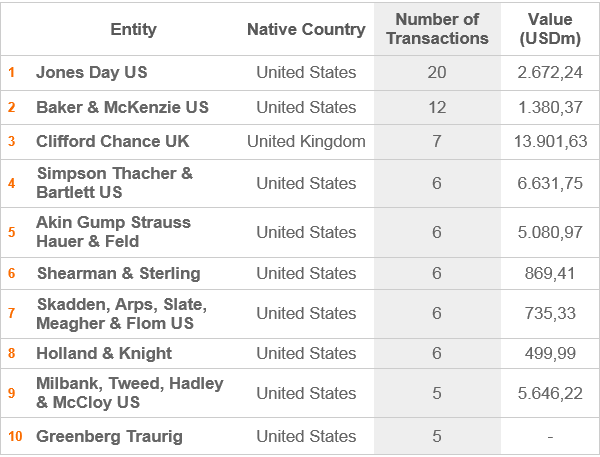

Legal Advisory – Year to Date (YTD)

Jones Day is up from fourth place a year ago to take a comfortable lead in TTR’s Latin America legal advisory ranking with 20 deals worth a combined USD 2.7bn YTD, representing a 67% increase in volume and a 37% increase in combined deal value compared to its 12 deals worth just under USD 2bn a year ago. Baker & McKenzie is down 48% by volume and 84% by aggregate value in second place with 12 deals worth USD 1.4bn, compared to 23 a year ago worth USD 8.8bn, when it held the top position in the regional ranking. Clifford Chance, absent from the top 10 a year ago, ranks third with seven mandates YTD worth USD 13.9bn combined, giving it a comfortable lead by aggregate value. Simpson Thacher & Bartlett fell two places in the ranking relative to its position at this time last year with six deals under is belt worth USD 6.6bn, compared to 13 a year ago worth USD 6.5bn. Akin Gump Strauss Hauer & Feld ranks fifth, also with six deal mandates YTD. Tied by deal volume with Simpson Thacher and Akin Gump are Shearman & Sterling, Skadden, Arps, Slate, Meagher & Flom and Holland & Knight, none of which have broken the USD 1bn mark in combined deal value YTD. Of the three firms, only Holland & Knight appeared in the top 10 ranking a year ago, when it brought up the rear with five deals together worth USD 3.1bn. Millbank, Tweed, Hadley & McCloy, in ninth, was absent from the top 10 a year ago, while Greenberg Traurig has fallen from fifth in mid-September, 2014 when it’d advised on 11 deals worth USD 1bn, to take tenth with five transactions a year later.

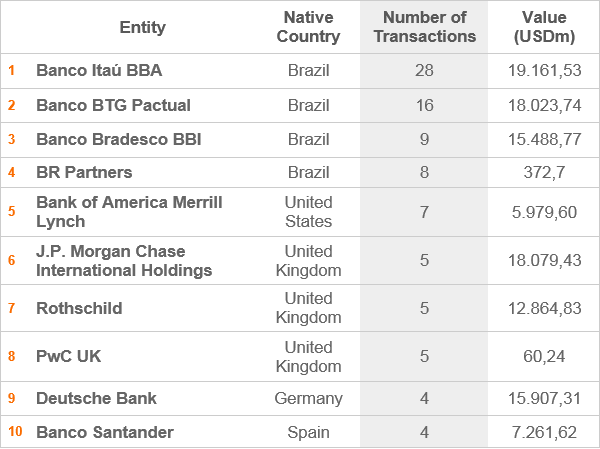

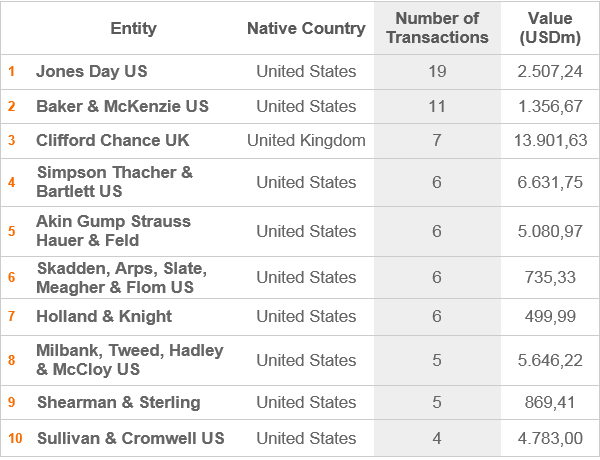

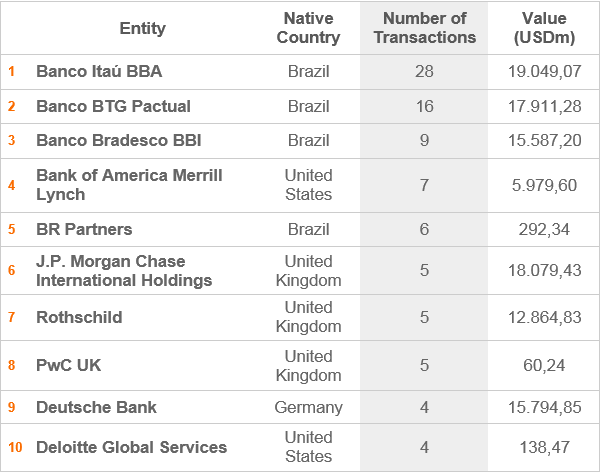

Brazil Ranking – 2015

Financial Advisory – Year to Date (YTD)

Banco Itaú BBA has a healthy lead in TTR’s Brazil financial advisory ranking at mid-September, with nearly twice as many deals as its closest rival, Banco BTG Pactual, which also trailed the leading bank in the number two spot a year ago. Notwithstanding, both banks are down by deal volume in their home market, 30% in the case of the leader from 40 deals a year ago, and 38% in the case of the number two bank, from 26 at mid-September, 2014. They are both up significantly by aggregate value, meanwhile, 331% from 4.4bn and 78% from USD 10bn, respectively. Banco Bradesco BBI holds to its third-place ranking of a year ago, with its nine deals worth USD 15.5bn compared to 12 worth USD 5.1bn a year ago. BR Partners is up four places in the chart relative to this time last year to take fourth with eight transactions under its belt, worth USD 373m combined, compared to five worth USD 556m a year ago. BAML rose from ninth a year ago when it’d advised on five deals worth USD 482m to take fifth place a year later with seven deals together worth just under USD 6bn, a 400% increase in deal volume and a 1,140% increase in aggregate value. JPMorgan, in sixth, was absent from the top 10 a year ago, as was Rothschild, in seventh, PwC in eighth and Deutsche Bank in ninth. Banco Santander fell from fourth in the chart a year ago, when it’d advised on 11 deals in Brazil worth USD 2.6bn, to bring up the rear with four worth USD 7.3bn thus far in 2015.

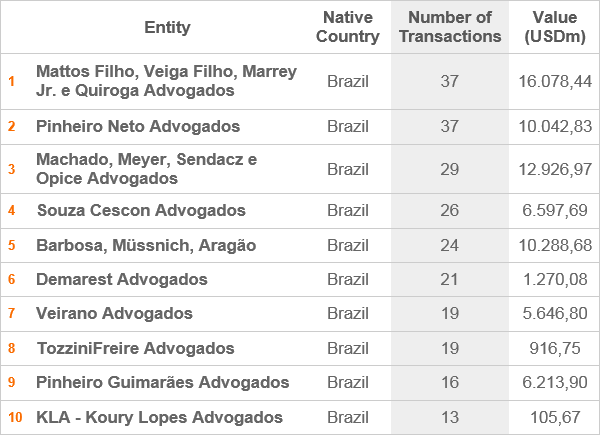

Legal Advisory – Year to Date (YTD)

Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados continues to hold a slim lead in TTR’s Brazil legal advisory ranking at mid-September, with 40 deals worth USD 16bn combined. A year ago, Mattos Filho also held the lead with 46 transactions together worth USD 8.8bn. Following closely in second, as it did a year ago, Pinheiro Neto Advogados has advised on 38 deals worth USD 10.1bn YTD, compared to 44 worth USD 6.8bn to mid-September last year. Machado, Meyer, Sendacz e Opice Advogados climbed one position in the ranking relative to a year ago, to take third, with 30 deals together worth USD 12.9bn, compared to 31 worth USD 2.2bn a year ago. Souza Cescon Advogados climbed two rungs to take fourth by deal volume, with 29 mandates on deals worth USD 6.6bn in aggregate, from 26 worth USD 11bn a year ago. Veirano Advogados climbed two positions relative to mid-September, 2014, to take fifth place. It has advised on 27 transactions YTD, worth a total of USD 5.8bn, compared to 25 for the corresponding period ending a year ago, together worth USD 1.5bn. Demarest Advogados also climbed two positions in the chart, in its case from eighth in mid-September, 2014 to sixth a year later, with 22 deals under its belt then, worth USD 2.1bn, and 26 worth US 1.9bn a year later. Barbosa, Müssnich, Aragão climbed three places from tenth a year ago, when it had 20 mandates under its belt together worth USD 4.9bn, to take seventh with 25 transactions worth USD 10.4bn. This represents a 25% increase in volume and a 113% increase in aggregate deal value. Pinheiro Guimarães Advodagos, in eighth, is up 300% by volume and 266% by aggregate value from this time last year with its 20 deals together worth USD 6.8bn. TozziniFreire Advogados fell four places over the same period to take ninth, down 29% by volume and 73% by aggregate deal value. KLA deals are down 41% by volume and 94% by aggregate value, resulting in its fall from ninth in mid-August, 2014 to tenth a year later.

Mexico Ranking – 2015

Financial Advisory – Year to Date (YTD)

TTR’s Mexico financial advisory ranking has changed little in recent months with sparse deal closings throughout the summer. BBVA leads the chart, as it did in mid-September, 2014, with four deals together worth USD 2bn, compared to three a year ago. Pablo Rión y Asociados ties by deal volume, its four deals worth a reported USD 81m. Banco Santander is up from tenth a year ago, when it had advised on one transaction in the first nine-and-a-half months of the year, to take third, with three deals worth USD 864m combined. Alfaro, Dávila y Ríos follows with two transactions together worth USD 2.2bn. Credit Suisse Group, in fifth, has also advised on two deals, in its case worth USD 1.3bn. Evercore Partners, Lazard and Vace Partners have two deals apiece under their belts as well. All three were absent from the top 10 a year ago, as was Pablo Rión, Alfaro, Dávila y Ríos and Credit Suisse. BAML, in ninth, has also advised on two deals YTD in Mexico, as it did for the corresponding period in 2014, when it ranked seventh. Deutsche Bank fell six positions in the chart relative to this time last year to bring up the rear with one transaction worth USD 2.5bn, putting it in the lead by aggregate value. In the first nine-and-a-half months of 2014 it advised on two deals worth USD 1.5bn combined placing fourth.

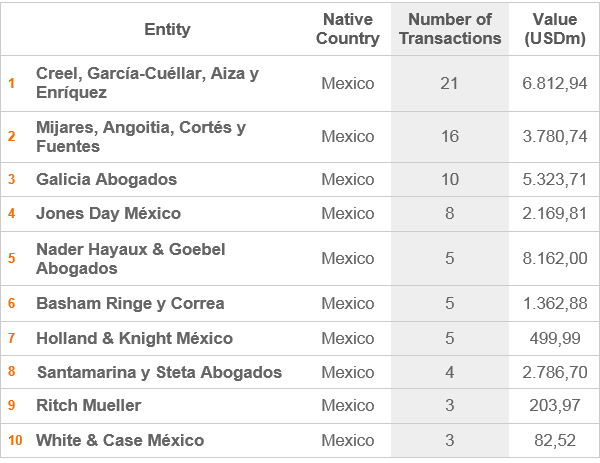

Legal Advisory – Year to Date (YTD)

Creel, García-Cuéllar, Aiza y Enríquez continues to lead TTR’s Mexico legal advisory ranking at mid-September, as it did a year ago. The country’s top firm has advised on 21 transactions YTD worth a combined USD 6.8bn, compared to 20 a year ago together worth USD 8.6bn. Mijares, Angoitia, Cortés y Fuentes follows, as it did a year ago, with 16 transactions worth USD 3.8bn, which represents a 33% increase in volume and a 56% increase in aggregate value relative to its 12 deals worth USD 2.4bn for the nine-and-a-half months to mid-September, 2014. Galicia Abogados climbed two positions relative to its ranking at this time last year to take third, with 10 deals together worth USD 5.3bn, up 67% by volume and 356% by aggregate value from its six worth USD 1.2bn a year ago. Jones Day grew deal volume by 300% in the past 12 months in Mexico to rank fourth, after not placing among the top 10 in the first nine-and-a-half months of 2014. Nader Hayaux & Goebel Abogados, in fifth with five deals, leads the chart by aggregate deal value of USD 8.2bn. It too was absent from the top 10 a year ago. Basham Ringe y Correa climbed two positions to take sixth relative to this time last year, also with five deals, compared to three a year ago. Holland & Knight, holds to its seventh-place ranking of a year ago. The firm also advised on five deals YTD in Mexico, compared to four by mid-September, 2014, while aggregate deal value dropped 78% from USD 2.3bn to USD 500m over the same period. Santamarina y Steta Abogados, in eighth with four deals under its belt YTD, was absent from the top 10 a year ago also. Ritch Mueller fell six places from third a year ago to ninth, with three mandates YTD worth USD 204m compared to eight a year ago worth USD 2.8bn, representing a 63% drop in deal volume and a 93% drop in aggregate value. White & Case also fell six places, from fourth to tenth, as mandates declined 57% by volume and 88% by aggregate value, from seven worth USD 686m in mid-September, 2014, to three worth USD 83m a year later.