Transactional Impact Monitor: Mexico – Vol. 3

30 December 2020

TTR’s Transactional Impact Monitor (TIM) is a Special Report combining local knowledge and market visibility from top dealmakers developed to address extraordinary situations affecting the macroeconomic stability and M&A outlook in core markets

INDEX

– M&A Outlook

– Private Equity

– Capital Markets

– Handling the Crisis

– Dealmaker Profiles

There is no doubt that 2020 has been one of the most challenging years in Mexico for decades, made all the more difficult by the slow reaction and absence of mitigating measures provided by the government, in contrast to most other nations.

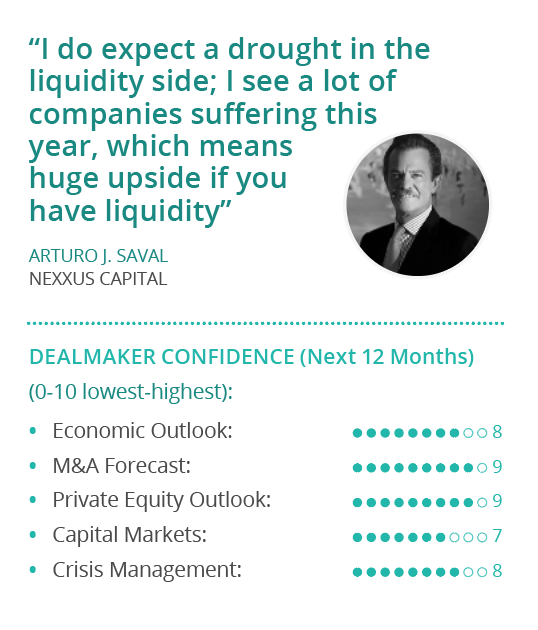

“Mexico has endured a deeper recession because we haven’t had the government support,” said Nexxus Capital Founder and Chairman of the Board Arturo Saval. “I’ve never lived through anything like this.” Several sectors have been put under enormous stress, he noted, none more so than the country’s normally booming hospitality industry.

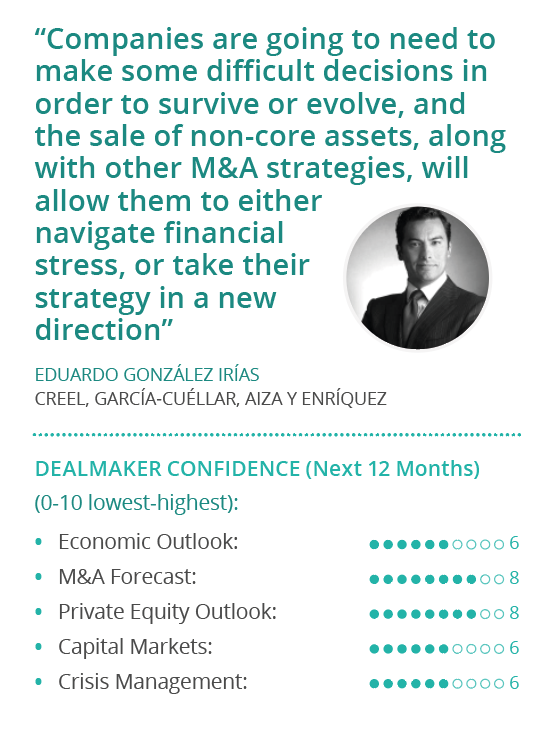

If there’s any optimism in Mexico’s business community as 2020 draws to a close, it’s relative to the dire pessimism that pervaded at the close of the first quarter, said Creel, García-Cuéllar, Aiza y Enríquez Partner Eduardo González.

There was great uncertainty over how the markets would react, González recalled, and many transactions that were on the cusp of closing were suspended as a result, some led by financial sponsors that relied on credit lines with local banks, others that depended on international financing. International lenders froze loan processing for several months, putting deals that relied on debt on ice, González said.

Mexico’s private sector has been damaged, and the health of the country’s financial system remains precarious, said Saval. Of Mexico’s 51 banks, 25 will have a very hard time, and some will shut down for good, Saval predicted, which will put extra pressure on the large ones that remain, many of which are based overseas and are facing stress in their home markets as well. “There will be a lot of stress in the banking industry globally, which will make them reluctant to increase their exposure in Mexico,” he said.

The downturn has affected deals in a range of sectors, from construction to chemicals and consumer products, with some proving far more vulnerable than others, González said. “We saw up close people trying to get out of signed deals, invoking force majeure events or breach of contract,” he noted.

The uncertainty clouded financial projections, with no assurance that companies would be able to maintain their revenue and EBITDA margins in an unknown economic climate, he added. “Nobody thought they’d be able to maintain their sales volumes; nobody knew how the world economy would work with everybody being asked to stay at home.”

There are sectors that have been severely affected, but many continue operating and the fall in sales and profitability hasn’t been as devastating as anticipated, which has resulted in cautious optimism, González said.

Some industries have indeed been flourishing, Saval noted, with the surge in e-commerce bolstered by Mexico’s lag in this area pre-crisis. The country is underleveraged compared to many of its peers in Latin America and state finances are in good shape, with the exception of the country’s national oil company Pemex, “mostly because of the position the government has taken”, Saval added.

Investment in Mexico’s energy sector has been impacted by the policy position of the Andrés Manuel López Obrador (AMLO) administration, which eroded investor confidence in the renewable energy market and put a damper on reforms passed by his predecessor, González explained.

Nonetheless, there are still investors out there for good assets, he said, and many, like China’s State Power Investment, which bought wind farm operator Zuma Energía in November, are accustomed to regulatory and political risks. The policy position of Mexico’s current government has made the energy sector less attractive, but renewable deals still command interest, he said. Similarly, appetite for Mexico’s road infrastructure among Canadian pension funds has also held up, González said, as evidenced by the recent sale of IDEAL.

Investment in conventional energy, on the other hand, faces tremendous hurdles, González said. “It’s difficult to understand the intentions of the government in areas that they themselves have politicized,” he said. “AMLO has consistently tried to make the petroleum industry a sacred cow for the people of Mexico for many years, and decisions governing the sector won’t likely be made based on any market intelligence, nor geopolitics, but rather for his own political benefit,” he added.

M&A Outlook

… Click here to access the third issue of Transactional Impact Monitor: Mexico – Vol. 3.