- Financial services deals peaked in September at seven

- Aggregate deal value in the Financial Services market fell 78% YoY to USD 775m

- Transaction of the Year: Banco Santander increases stake in Banco Santander México

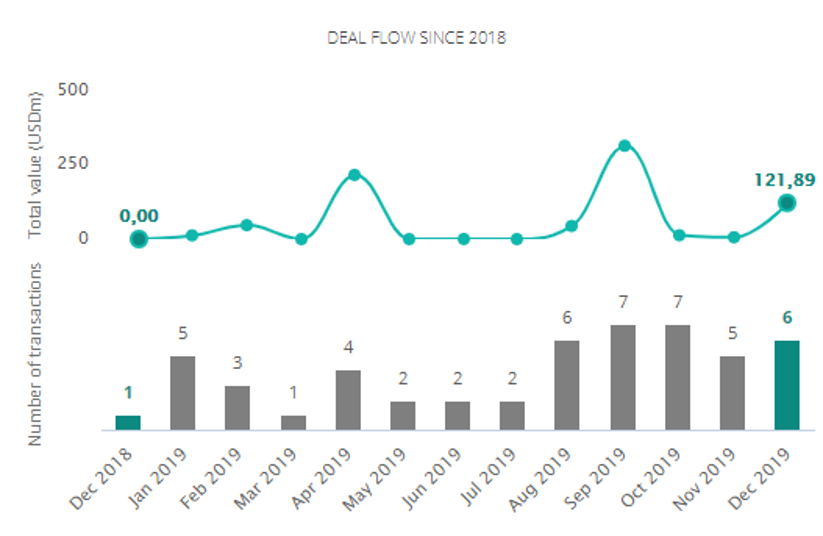

Mexico’s financial services sector registered 49 mergers and acquisitions in 2019, between announced and closed deals, for an aggregate deal value of USD 775m, according to Transactional Track Record (TTR) data.

Financial Services led deal-making in the country, ahead of tech and real estate, despite a 16% decline in deal volume in the sector and a 79% fall in aggregate deal value.

Transactions in the segment peaked in September in terms of volume and aggregate value, with seven deals in the ninth month of the year together worth USD 315m.

Cross-Border Deals

The UK led outbound deal-making among Mexico-based buyers with USD 40m invested in aggregate. The US led outbound deal-making by volume, meanwhile, with 14 transactions to the close of the December in the financial services sector.

Top M&A Deal

Banco Santander’s increase of ownership in Banco Santander México was selected by TTR as Deal of the Year in the Financial Services industry.

Banco Santander announced it will issue 381,540,640 new shares, representing 2.35% of the entity’s share capital worth some USD 216m.

Financial and Legal Advisory Rankings

Creel, García-Cuéllar, Aiza and Enríquez leads the Legal Advisory Ranking in Mexico with three transactions worth a combined USD 216m. Ritch Mueller is tied by aggregate value while Basham Ringe and Correa is tied by volume with the leading firm.