Informe trimestral sobre el mercado transaccional ibérico

- En el primer trimestre de 2015 el volumen de inversión de fusiones y adquisiciones se ha situado en EUR 34.491m

- Se han contabilizado 405 transacciones, incluyendo activos

- Los datos mejoran los registrados en el primer trimestre de 2012, 2013 y 2014

Madrid, 13 de abril de 2015.El mercado de fusiones y adquisiciones español mantiene su tendencia positiva en 2015 y en el primer trimestre del año ha contabilizado un total de 405 transacciones por valor de EUR 34.491m, lo que supone unos aumentos interanuales del 22,7% y del 119,6% respectivamente, según el informe trimestral de TTR (www.TTRecord.com) Este registro supone el mejor comienzo de año de los últimos cuatro registrados, ya que los datos mejoran los contabilizados en el primer trimestre de los años 2012, 2013 y 2014, tanto en número de operaciones como en importe de las mismas.

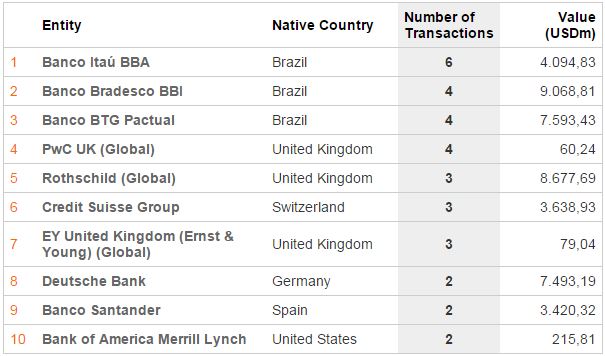

Hasta el 31 de marzo de 2015, se han producido 13 operaciones de mercado alto (importes superiores a EUR 500m) con un saldo de EUR 29.746,3m, 14 operaciones de mercado medio (entre EUR 100m y EUR 500m) con un importe agregado de EUR 2.336,8m, y 144 operaciones de mercado bajo (menores de EUR 100m) con 2.407,9m. Estos registros han permitido que el volumen de inversión se sitúe en EUR 34.491m, pese a las 234 transacciones contabilizadas con importes confidenciales.

Por sectores, los más activos durante el primer trimestre del año han sido el sector inmobiliario, con 86 operaciones, el sector de Internet, con 35, y los sectores alimentario y financiero y de seguros, que han registrado ambos 31 transacciones.

Ámbito cross-border

Por lo que respecta al mercado cross-border, las empresas españolas han elegido como destinos principales de sus inversiones a Estados Unidos (8), Portugal (7), Reino Unido (7) y México (5); mientras que el mayor desembolso lo han realizado en Reino Unido (EUR 2.851,1m), Portugal (EUR 1.103,3m) e Italia (EUR 693m).

Por otro lado, son Francia (16), Estados Unidos (14), Reino Unido (9) y Luxemburgo (6) los países que mayor número de inversiones han llevado a cabo en España; mientras que los que mayor desembolso han realizado han sido Kuwait (EUR 3.050m), Reino Unido (EUR 2.704,4m) y Líbano (EUR 730m).

Aquisições feitas por empresas estrangeiras em Portugal

Em relação as aquisições realizadas por empresas estrangeiras em Portugal, as empresas espanholas foram as mais cativas no primeiro mês do ano, com 5 aquisições que se distribuíram pelos segmentos de automóveis, imobiliário, indústria alimentar, certificação, e tecnologia. Em segundo lugar estão França e Estados Unidos, com uma aquisição cada um.

Private equity y venture capital

Respecto al segmento de private equity, en el primer trimestre de 2015 se han registrado 37 operaciones con un capital movilizado de EUR 1.885,6m. Esto supone un incremento interanual del 15,63% en el número de operaciones, aunque el capital movilizado ha experimentado un decremento del 25,79%.

Por su parte, en el mercado de venture capital se han contabilizado en el primer trimestre del año un total de 54 operaciones con un importe de EUR 281,8m. En este caso es el número de operaciones el que es ligeramente inferior al mismo periodo de 2014 (54 frente a 55), mientras que el capital movilizado ha experimentado un incremento del 556,52% (EUR 281,8m frente a EUR 42,9m).

Mercado de capitales

Por último, en el mercado de capitales español se han cerrado durante el primer trimestre del año un total de 8 ampliaciones de capital con un importe agregado de EUR 14,5m, y tres salidas a bolsa (AENA, Saeta Yield, y Uro Property Holdings Socimi) por valor de EUR 4.569,2 m. Además, han quedado pendientes algunas operaciones que se espera que se cierren en los próximos meses y que auguran un 2015 muy activo en este segmento del mercado.

Transacción del trimestre

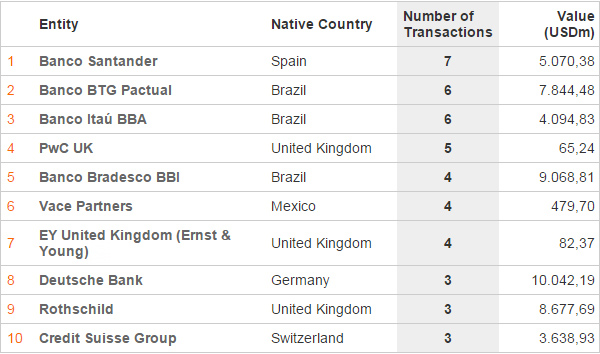

En el primer trimestre de 2015, TTR ha seleccionado como transacción destacada la adquisición a E.ON de E.ON España por parte de Kuwait Investment Authority y de Macquarie Group, que ha movilizado un total de EUR 2.500m. La transacción ha estado asesorada por la parte legal por Linklaters Spain, PwC Tax&Legal España, y Pérez-Llorca, y por la parte financiera por Citibank España y PwC España. Además, Ey España, PwC España y KPMG España han llevado a cabo procesos de Due Diligence.

Para más información:

Leticia Garín

TTR – Transactional Track Record

Tlf. + 34 91 279 87 59

leticia.garin@ttrecord.com

www.TTRecord.com